Le Parisien Determined to Identify What Voters Believe in place of what elites believe they believe.

Paris’ leading daily newspaper, the tabloid Le Parisien-Aujourd’hui en France has outlawed from its pages all poll-based predictions on the pending presidential election.

The centrist popular daily blames unquestioning reliance on polls, known in France as “soundings” to have led to the embarrassing set of circumstances in which Alain Juppe was unanimously predicted to become the successful candidate of the right-of-centre Republican Party.

In the event, and as MSC Newswire’s European correspondent had predicted, (see our story below) the successful candidate was Francois Fillon who now becomes the favourite to win the pending presidential (i.e. general) election.

In the same forecast, MSC Newswire had also predicted that current president Francois Hollande would not be the Socialist Party candidate in the election. In the event, and several days after our prediction, Mr Hollande stood down.

Meanwhile, according to Le Parisien, the elimination of polls, soundings, and other tendentious content will be replaced by plain and simple reporting.

The objective being to report what people are in fact thinking in place of the former practice of reporting on what a narrow elite believe, or want to believe, everyday people are thinking.

According to our European correspondent, Alain Juppe’s “Happy Identity” slogan was only finding approval among the media.

Similarly Mr Juppe’s involvement with a funds scandal, which had caused him to live in Canada, was taken seriously by voters, if not the media.

Also, the idea of a Clintonesque co-presidency (see front page), while attractive to the media, nonetheless dismayed the public at large, as it did voters in the United States presidential election.

| From the MSCNewswire reporters' desk | Thursday January 5 2017 |

The End of the Politically Correct

Our foreign correspondent forecast the Trump victory, and now previews the fall of France’s Francois Hollande ....

| Napier, MSCNewsWire, Nov 24, 2016 | - The predicted fall of France’s president Francois Hollande in next year’s election will bring to a close the initial era of political correctness. He is scheduled to become the third big-economy leader victim within less than a year of the accelerating electoral power of the non-political class.

Mr Hollande is known as the King of Consensus. His determination prior to any decision to canvass every opinion and nuance in his own Socialist Party and also in the string of other French leftward parties conveyed an impression of dithering in the face of islamic insurgency.

Instead of being seen to be heading a tough reaction Mr Hollande’s nature lead him to be more at home leading candle lit marches, vigils and uttering trite panaceas in the face of the emergency. It was left to his prime minister Manuel Valls to express the public mood about the threat throughout France of rampant religious extremism.

Worse still, Mr Hollande was viewed as being over-preoccupied by the star studded Paris climate conference with its breathtaking ritual insights into the blindingly obvious instead of with the much more visible and immediate terrorist threat

The most visible manifestation of Mr Hollande’s pending loss of the presidency is the number of his own hand-picked cabinet members who are deserting the sinking ship. The “frondeurs” as the rebels are known are setting themselves up, they are still in their 30s and 40s, for the 2022 election.

There is though in the anticipated disappearance of Mr Hollande a signal point of difference with those other landmark scupperings of the political classes, Brexit and Trump. The difference is that this time everyone is expecting it.

The winner of the French Republican Party primaries is now looked to as the winner of the presidency. This is looking, in fact, increasingly like former premier Francois Fillon.Mr Hollande’s political career has been an inch-by-inch bureaucratic progression characterised by a reverse Clinton-effect process.

His life-mate Segolene Royale (pictured above with Hollande) with whom he has four children was the glamorous one. Her attempt to crack the French version of the glass ceiling was more spectacular than anything attempted by Hillary.

In the event she lost to Sarkozy.

It was now that that the blander Francois entered the lists and in doing so streamlined his approach by parting from Segolene. The go-it-alone Francois now beat the unpopular Nicolas Sarkozy and the ElyseesPalace was his and his Socialist Party’s.

Four and a half years later he looks like a president who knows he can’t win. He is unlikely to hand over to the rather more decisive figure of his prime minister Manuel Valls.

No major economy leader, not even President Obama, personifies so closely as does Francois Hollande the twin pillars of diversity and multiculturalism which in France’s case are supercharged by the Revolutionary code of the Rights of Man.

Few doubt his sincerity of purpose. It is just that as with the other casualties of this new wave politics, the Clintons, he found himself reading from an out-of-date script.

Oceania Free Trade will give Lowlands a conflict-free market zone which Canada deal will not

The EU’s stop-go trade deal with Canada points up the obvious advantages that the Lowlands, notably Belgium, will derive from a similar such arrangement with New Zealand

The Walloons, the Belgium-region which vetoed the Canadian deal, has been scorned for its obstructionism. Yet in fact a single market with Canada poses immense problems to Belgium which was once the European powerhouse of the Industrial Revolution.

Here are some of them:-

- Canada’s heavy engineering sector, notably in the form of Bombardier, will compete directly with EU’s heavy industries notably in planes and trains.

- Canada’s food manufacturing in the form of Weston among others will compete directly with EU producers everywhere.

- · Canada’s milk production is the most heavily licensed, regulated and restricted in the entire world

- United States manufacturers and production engineers will now source in Canada their exports, notably vehicles, to the EU and thus claim single market privileges and preferences

- Canada’s banks are superbly regulated and equally finely managed and have safely absorbed every global crisis. They will now compete on equal terms with the EU’s own banks.

Now in beneficial contrast let us look at what the pending New Zealand – EU holds in store for the Walloons and everyone else in the EU zone:-

- New Zealand’s heavy engineering is confined to production processing and thus there is no conflict in the key transport sector

- New Zealand’s big-league food manufacturing such as Heinz Watties is already foreign owned and will thus present no fresh competition

- New Zealand milk production scene is already open to EU manufacturers who are encouraged to have plants here. EU’s Danone and Parmalat are two examples

- New Zealand offers no back door opportunities to other nation-state manufacturers

- New Zealand’s banks are owned in Australia. The only competition in fact comes from the Lowlands-owned Rabobank.

If the Walloons are still wallowing in any misconception about the straight-out benefits of the New Zealand arrangement then they can comfort themselves in some historical background. This might include for example the fact that both countries are roughly the same age, having been founded in the middle of the 1800s.

Both countries can thank Britain’s Lord Palmerston for their existence. It was Lord Palmerston who organised the carving out of Belgium from the Netherlands. Similarly Lord Palmerston’s hand was evident in the creation of New Zealand where he is celebrated with a number of place-names.

From the MSCNewsWire reporters' desk - Sunday 31 October 2016

Questions Float about IPO ticket-clip

The mooted litigation-funded class action against the Wynyard Group faces an immediate two-fold problem. This is exactly what entities are in the firing line of this proposed action, and how will any desired reparations be extracted from these entities?

Are we looking here, for example, at Britain’s Skipton Building Society? This financial services organisation is usually cited as controlling the Jade computer services organisation from which the Wynyard Group originated.

There are several problems here.

One is that the Skipton Building Society–Jade organisation’s association with Wynyard Group is rather more tenuous than is widely supposed. For example, instead of seeding its new offspring with funding, the British organisation appropriated for itself a very large part of the original investment from the NZX flotation. The exact benefit of this to the fledgling offspring, the Wynyard Group and its shareholders has been complex to define and similarly with the labyrinthine ensuing cross-over obligations between the two companies.

If the Wynyard class action group has in its sights any other investors and/or promoters in Jade then there is the problem now of their being domiciled outside the Westminster jurisdiction. This especially applies to Jade investors in the United States.

In so many ways the Wynyard Group flotation represented New Zealand equities investors at their finest and most patriotic in their willingness to put their money behind the home team. You have to live in Christchurch to understand the intensity of this willingness to back the local side which Jade once was, and so, much more recently, was its Wynyard offshoot.

In the event Jade began in the desert, the Saudi Arabian one, where two New Zealand programmers were working as IT specialists for a Saudi distributor of United States earthmoving equipment. A problem in the 1970s that hit the engineering and construction equipment and stock holding business everywhere was the arrival of double digit inflation. The danger to engineering suppliers in this was selling parts and even full scale pieces of equipment at below their replacement cost.

It was now that the two programmers, with time on their hands, set out to solve this problem. They did so by devising a real time and online (ie instantaneous) system which meant that price increases from suppliers rippled out to all warehouse and outlet supply depots across the planet and as they occurred. This was a colossal breakthrough by any standard and became more so as the two programmers now proceeded to package it and market it

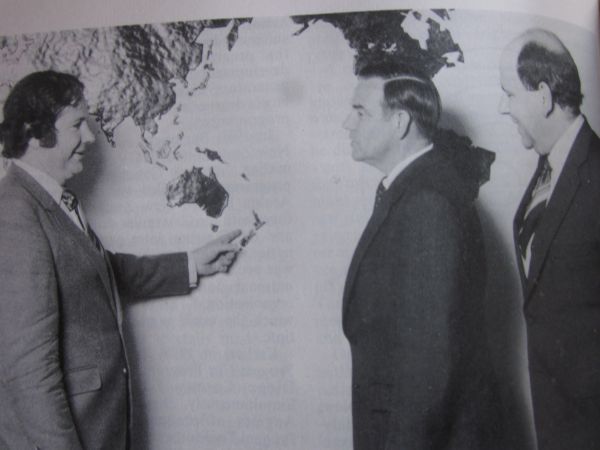

Burroughs, then a major force in world computing, ranking only just behind IBM, recognised the value of this discovery and in a remarkably short space time branded it as LINC (for logic and information network compiler) and put it in the very top shelf of their worldwide marketing. Our photograph shows Gil Simpson (at left) with his co-developer Peter Hoskin. In the middle is Robert Holmes the Burroughs top sider who oversaw the deal.

It was now that Jade made Christchurch in the 1980s one of the world hubs of network computing science. It really was a “centre of excellence.” The Linc compiler with its rapid implementation automated programming was the unique selling proposition, the secret. While the Linc project never actually became fourth generation (as was widely claimed for it) the product in that era got as close as any other system did to replicating the wave or multi-processing operation of the human brain.

All the rest followed. The Jade Stadium, Sir Gil Simpson Drive, and of course Sir Gil himself. Peter Hoskin, the co-developer, faded out of direct involvement and in recusing himself became the New Zealand version of those other early self-sidelined co-developers Paul Allen and Steve Wozniak.

Time moved on, and it was now that as so often in the IT sector, time from being an ally now manifested itself as a problem, especially at Burroughs, which by now had re-named itself Unisys. It was still a big-iron, mainframe manufacturer of centralised computers. It was now besieged by the personal computer manufacturers.

Even as Burroughs – Unisys became distracted, it was still able to use its muscle in its stronghold of mainframes to insert the Jade Linc system into the financial sector notably in the United Kingdom. It was now that started the supplier-client relationship of Jade with the Skipton Building Society.

Exactly why, and how Skipton became anchor investor in Jade remains largely unclear. There are though grounds for believing that Skipton needed to protect its own investment in its own Jade systems and did so by investing in the supporting supplier.

Even so, Jade was careful always to diversify its own market and took up a strong footprint in logistics, a natural growth sector deriving from its original inventory management expertise.

It was as part of this sector application diversification scheme that Jade sought out still newer fields in which to apply its compiler expertise. Law enforcement/risk management made sense.

Jade was by now encountering the problem of companies outside the United States to the effect that no matter how effective their products, no matter how much they tuned and re-tuned their underpinning quantum mechanics not to mention their marketing, they still seemed the poor relation to Silicon Valley. Especially in its ability to launch torrential new products on a marketplace that had become attuned, if not addicted to fast-rotating product issue frequency.

Canada’s Research in Motion with its Blackberry and Finland’s Nokia are two examples of seemingly invulnerable companies that succumbed to this kind of Silicon Valley rolling release.

Wynyard for example walked into this kind of Silicon Valley deep-pocket storm when it found itself confronted with sometime New Zealand resident and Tolkien buff Peter Thiel’s Palantir crime product.

Wynyard because of its Anglo-United States lineage had about it from the start an aura of the gilt edge. This halo was emphasised by its role as New Zealand’s first heavy-end departmental-capability IT main board listing. As is the IT custom everywhere the claims and forecasts made on its behalf contained a show-business extravagance and the executives seemed more photogenic than in other industries. The explanation for this multiplier is that if you win big in IT you win bigger than you do in other industries.

In the event, and as we can all see now, it was highly speculative and depended for its success on an early investment take up. One ideally in the form of a mainstream merger or acquisition that would have given Wynyard scale and the global distribution and sales and support channels that it always needed.

It does now all seems so unfair. Jade in its day took automated programming, meaning fast setup, further than any other technology outfit anywhere. It survived the 1987 bust, the dot com bubble, and the Great Financial Crisis.

But now its offshoot and which carries its pedigree is left to fade unfinished into the history of New Zealand ultra-advanced technology.

From the MSCNewsWire reporters' desk - Wednesday 2 November 2016

New Party will shake up self-serving Members of Parliament

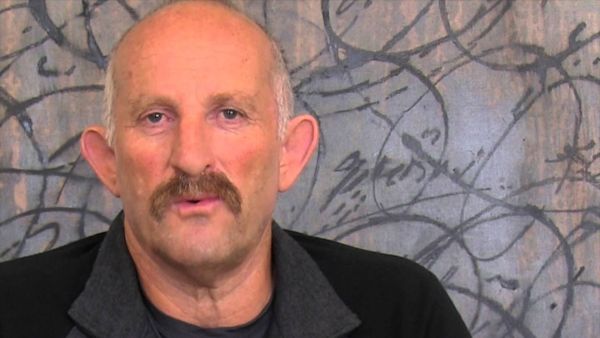

Like a South Seas version of Donald Trump New Zealand economist–philanthropist and family man Gareth Morgan has launched himself into the firmament of Oceania politics astride his own freshly minted political party and has done so with the same purpose which is to introduce a new order to replace the current one in which he sees Members of Parliament primarily fixated on becoming MPs. Then remaining MPs.

Mr Morgan proclaims that he intends to “light a fuse” under the existing order and thus break the stranglehold that he claims “career” politicians have on the nation of under five million people.

Igniting his “fuse,” in the form of his Opportunities Party on the eve of Guy Fawkes, he does not object to being compared to Donald Trump in terms of Trump’s determination to smash the status quo.

The Opportunities Party will start issuing segments of its manifesto soon.

Mr Morgan’s decision to launch his own political vehicle comes as no surprise. The Welsh-born economist was a household business name before his family began and then spectacularly sold its version of Ebay.

The family’s TradeMe online site which replaced newspaper classified advertising was sold to the Australian-based Fairfax media chain for $700,000,000. This was approximately the same amount that News Corporation paid at the same time for Myspace which was at the same time one of the world’s busiest social networking sites. When additional management contracts were taken into account the sum is considered to have been in the region of NZD1 billion.

The problem for the new acquirer, Fairfax, was that TradeMe which retained its saturation in New Zealand had mixed results in market penetration internationally, notably in Australia.

In addition to his family’s wealth, Mr Morgan fills the other side of the equation for being admired in New Zealand which is that he is a sportsman being, with his wife, a big capacity motorbike traveler across the world’s most demanding terrains.

It is unlikely that Mr Morgan will have any problems in acquiring the 500 members required in New Zealand for his new party to obtain official recognition.

Mr Morgan is likely to enjoy from the wider voter spectrum approval for lighting the blue touchpaper under the seats of “career” politicians, an unknown species in New Zealand until the 1980s.

Until that time Members of Parliament were drawn from those who had served as farmers, businessmen or commercial lawyers (National Party) or trade unionists, educationalists or advocacy lawyers (Labour Party.)

From the 1980s onward the trend became defined for candidates to start aiming for election at an early age and to bring with them, if successful, no previously acquired practical or applied experience beyond that of campaigning and boondoggling to become an MP.

It remains uncertain if Mr Morgan will offer himself as a candidate for his new party. A problem for him will remain that in spite of proportional representation being well installed in New Zealand, it has not propagated the same diversity of splinter parties which it has done, for example in Latin nations where it has long been standard.

The two monolithic parties continue to dominate. Though with a degree of permutation and combination with smaller parties, notably Greens and Maori, and the Winston Peters New Zealand First.

However, Mr Morgan’s move will act to crystallise disquiet about the general numbers, terms and conditions, especially those relating to emoluments of New Zealand’s sitting MPs. There are 120 of them, and they are rather better paid than their 650 counterparts in Westminster.

He will tap too into electorate disquiet about the ease with which their pay increases enjoy easy legislative passage at a time when everyone else is being urged to tighten their belts. Similarly with the seemingly infinite career duration of certain members along with the perennial matter of MPs long-tail entitlements.